Readers, I’m excited to announce the new Travels With Ivan blog at TravelsWithIvan.com Thanks to your valuable feedback and readership, I’m improving the quality of my product to better serve you, including a dedicated, shorter… More

Booking Award Flights to Asia on ANA Miles

We hope to visit both our grandparents in Asia in 2017, so I started exploring options and routes. Since I had some ANA miles from a previous redemption that I ended up canceling (for free due to schedule changes), I wanted to use those ANA miles for this trip.

Award availability on ANA (*A flights) seem to be pretty good for winter 2017 travel. They have a lucrative award chart and good redemption values for both economy and business class travel. I logged into the ANA website and started searching:

I would not pay cash for business class travel, but the award redemption rates are often tempting compared to economy. Furthermore, sometimes only business class redemptions are available, probably because the airline thinks they can sell out the economy cabin, but not the business class cabin. This presents an example of the calculations, opportunity cost analysis, and internal turmoil I am often confronted with while planning. Here is why (this is a typical real-world scenario):

Let’s say a flight SFO-HKG costs $1,000 r/t in Economy and that same ticket can be redeemed for 40,000 miles. The same flight in Business costs $6,000, but with miles its only 80,000. For only two times the miles, you get six times the value.

The opportunity cost is that you could get two economy tickets for the price of one business fare. That’s when you start to consider award availability, your mileage inventory, and the acquisition cost of additional miles. When I have a surplus, or when a program is about to devalue, I often attempt to liquidate using whatever means possible. And if there is business availability, but not econ (which is sometimes the case), using your miles is a better choice than not using them at all.

There is also a common measure for the value of an award redemption called “cents per mile” or CPM. In the above example, you get 1,000/40,000 or 2.5 CPM with one ticket, and 6,000/80,000 or 7.5 CPM. This is an over simplified way of estimative the value of your mileage redemption. I’ll write another post about why I don’t rely on it, but only use it as a starting point when determining whether or not an award is a “good use of miles”.

In conclusion, I normally redeem miles for economy class travel because that is how I stretch my miles. However, occasionally I splurge (with points) a bit and go for the nicer seat redemption when the situation calls for it. That’s another beauty of this hobby, having the option to enjoy experiences that are normally cost prohibitive or an unwise use of cash.

Have you redeemed miles for premium travel?

What to Evaluate When Signing Up for Credit Cards

Its been more than 6 months since my mother signed up for a credit card. I’ve been busy helping my in-laws get started with this hobby and working on other things. Thankfully, I have a calendar system that keeps track of my family’s sign up history and a reminder said “its time to make good use of your resources”. This includes of course, leveraging underutilized good credit to take advantage of sign up bonuses, which results in reduced life or travel expenses.

Here is the workflow:

- What’s the strategy?

- What’s on the schedule?

- Has anything changed with her strategy?

- What cards does she have?

- Check credit score + inquiries.

- Narrow down choices with final internet research.

- Add referral bonus if applicable.

- Apply (use incognito/private mode).

When I help get people started on this program, the first thing I do is help them understand what they want. Do they want to spend less money overall (cash back)? Do they want premium travel experiences (high-value point redemptions)? Or do they want to take a couple of domestic trips a year to see friends and family (flexible points currency)? I encourage people to be clear in what they want in order to derive maximum satisfaction out of this journey.

My mother wants to take one or two major trips per year, but the destination could either be domestic or international. Thus, her strategy is to target Chase Ultimate Rewards (UR) points for maximum flexibility and transferability.

She’s been at this hobby for a couple of years now, so we developed a project schedule/tracker that documents current/past cards as well as future cards to consider that align with her strategy. According to her schedule, the Ink Plus is up next. Her strategy has not changed, and has been reinforced due to Chase’ upcoming 5/24 rules that only allow credit card approvals to those who have had 5 or less inquiries within 24 months. I normally encourage 2-3 cards per application to efficiently ‘batch’ work, including documentation overhead and meeting minimum spend requirements. Furthermore, some credit bureaus will combine multiple inquiries, allowing you to qualify for more cards on the long run.

If I apply for two chase personal cards in the same day, those credit pulls get combined into one, which reduces my overall credit inquiries, increasing my chances of approval for future cards. Note that this works in-kind only (2 business inquiries -> 1 business inquiries, 2 personal inquires -> 1 personal inquiries). So, I wanted to find another business card in addition to the Ink Plus.

The Chase Marriott Rewards card seemed lucrative, but the business version costs $14 more in annual fee, and does not include the 7.5k bonus points for adding an authorized user. Both versions had $3k minimum spend requirement (MSR), and I value that more than a pull, so I decided to go for the personal version. I also wanted to combine an inquiry, so I added in the Chase Freedom card, too.

So the three cards I was looking at was the Chase Ink Plus, the Marriott Personal, and the Chase Freedom.

Final due diligence

I then checked her credit scores and made sure she has less than 5 inquires in 24 months. I also performed light internet research to understand risks and approval chances based on other’s experiences. I learned to add this step the hard way when I applied for Chase cards the week after the 5/24 rule was implemented suddenly and news started to spread on the forums. I was denied and I could have saved a hard pull. After reading through the forums I realized that the card that was most important was the Ink Plus. It is also difficult to be approved for more than 2 Chase cards in one day.

Hence, I decided to go for just the Ink Plus. Since my father already has the Ink Plus, I could use his account to refer my mother and gain bonus points. It takes up to seven days for that email to be generated.

When she receives the referral email by next Thursday, she will setup incognito mode on her browser and apply for the Ink Plus!

Progress to book flights to Finland: Part 7 HEL to CPH connector

Progress to book flights to Finland: Intro

Progress to book flights to Finland: Part 2

Progress to book flights to Finland: Part 3

Progress to book flights to Finland: Part 4 Routes

Progress to book flights to Finland: Part 5 Final Route

Progress to book flights to Finland: Part 6 Route Optimization

The last route I needed to secure for our Finland trip was for our second destination, Copenhagen. We wanted to have two European destinations and decided to checkout this city in addition to Helsinki. To recap, I have already secured the flights to HEL and back from CPH. We split the itinerary into two one-way segments, so could not take advantage of a free stopover, which comes with roundtrip itineraries of most programs. Hence, we need a way to get from HEL to CPH.

We explored taking a boat to Stockholm, which is connected by rail to Copenhagen. However, the cost, travel time, and logistics required was quite complex and seeing Stockholm was not our priority.

Using ITA matrix, I identified several air carriers and the possible prices.

For this flight I can use BA Avios on Finnair, but the redemption isn’t the best use of the miles compared to the least expensive cash itinerary.

For this flight I can use BA Avios on Finnair, but the redemption isn’t the best use of the miles compared to the least expensive cash itinerary.

For example, I priced a midday departure out to 4,500 miles and about $60 in taxes required per person. The same flight costs about $100 per person. Using 4,500 miles to cover $40 is not ideal (less than 1 CPM). I don’t have an abundance of Avios and I would need to transfer valuable Chase UR points to make this work. UR points are worth much more than 1 CPM (I value them conservatively at 2 CPM).

If I determined that miles was a good redemption, after confirming the amount of miles needed, I would log into my Chase Ultimate Rewards account to make the transfer (which posts instantly). In past experiences I was able to refresh the BA website and purchase the flight. In our case, miles is not the best option, so I will stick with the flexibility of a cash fare. Furthermore, this gives me more flexibility to determine when I want to leave Finland, since award availability is currently limited to that one Tuesday in that week (which works out ok in my current calculations). And if I purchased the SAS flight, my Star Alliance Gold status gives me free luggage as well, in the case our luggage doesn’t meet their carryon requirements.

Thus, I will continue to monitor prices and award availability. If things don’t change significantly in about a month, I will most likely purchase a cash fare with the best schedule.

What is your experience with open-ended, or open-jawed itineraries? Do you sometimes feel nervous about not having everything booked, or does the mystery and potential for more options excite you?

How to Travel on a New Airbus A350

While exploring routes for my upcoming trip to Finland, I discovered that Finnair is the first European Airline to take delivery of the new Airbus A350 airplane. It is the most quiet, comfortable, and fuel-efficient large passenger airplane yet. Its not everyday people get to try a new plane, so I want to share how you can find flights.

The inaugural flight schedules for the respective routes are posted on Finnair’s website.

I explored routes that fly the new plane and found that HEL-BKK is the most interesting option for me. What this means is a very real possibility of a future round-the-world trip with both Scandinavia and Asia in one shot. You can follow Finnair on Twitter to find when the HEL-HKG flights will begin.

What is your experience flying relatively new planes? Do you like the new-plane smell?

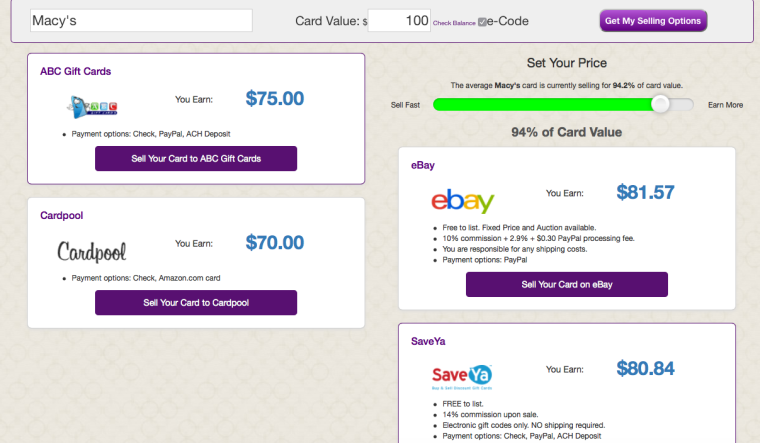

Update on selling unwanted gift cards

A couple months ago I had Macy’s gift cards I received as Christmas gifts that I was trying to resell.

I wrote this post explaining how I liquidate under-utilized/captive assets as part of a larger earning-strategy for travel.

At that time the market conditions were not favorable towards the seller because there was a surplus of unwanted gcs from the holidays, driving down the price.

I reevaluated the options today and found conditions to still be unfavorable. 75 cents on the dollar isn’t a great resale rate, but it could work for some people who would rather have cash now.

I’ll check again in a month to document any price differentials.

I’m not in a hurry to sell, but I don’t want to hold onto these gcs for too long either. All currencies devalue, though I wonder if in rare cases gcs of certain stores may retain their value relative to the US Dollar… perhaps an exercise for another post.

Have you sold gcs lately?

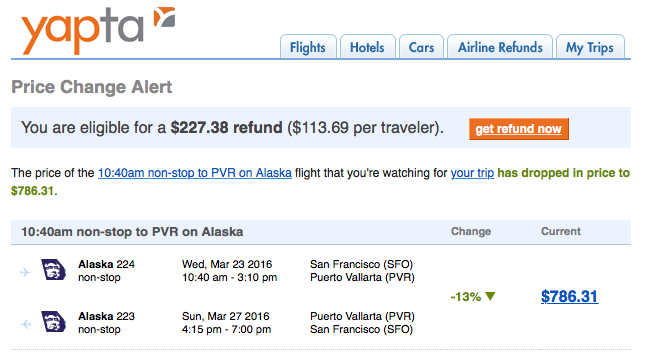

How to save money on airline tickets you’ve purchased

Most airline tickets are dynamically priced. This means that the price changes depending on when you purchase any given ticket. This is often a function of supply/demand (which often follow holiday schedules) as well as certain promotions.

Variations can be as short as minutes, though prices normally change day to day or week to week. Prices often increase closer to the date of the journey, but in some cases they can also drop.

To combat resentment and encourage impulse buying, many airlines have a return policy on the differential if the prices of the ticket drops after you purchase it. But you have to file a claim with the airline proving that has occurred. You have to know that the price has changed and searching for your exact ticket every day probably isn’t the best use of your time.

Yapta is a website that automates this search and notifies you when the price of at ticket drops, so that you can file a claim to refund the differential.

Here is an example of a flight with quite a variation in price.

I hypothetically purchased this flight for $900 last month. Yapta kept checking the current prices and sent me an email with a price change alert. $227 is quite a savings on $900.

To setup an alert, search for the flight you purchased (or is thinking about purchasing) and enter the price you want to set as the baseline. You can then set the alert criteria – for example, how much of a differential before an alert is sent.

Try out Yapta and write your thoughts in the comments!

Don’t forget to activate your Discover Q2 Promo

If you have the Discover card, don’t forget to activate your 5% cash back bonus from April to June. You will earn 5% Cashback Bonus on up to $1,500 in purchases at Restaurants and Movies from April through June 2016.

Its still March, so don’t forget to maximize the cash back on gas stations!

What is your experience using a cash back card to supplement your miles/points strategy?

Progress to book flights to Finland: Part 6 Route Optimization

Progress to book flights to Finland: Intro

Progress to book flights to Finland: Part 2

Progress to book flights to Finland: Part 3

Progress to book flights to Finland: Part 4 Routes

Progress to book flights to Finland: Part 5 Final Route

Now that acceptable flights were booked, I scheduled time on my calendar to regularly check availability on more ideal routes. Remember that your ideal itinerary is often not available at first, but you have opportunities to make adjustments later. The important thing is to book something that works.

Today, I went on AA to check on my outbound flight and sure enough, a Saturday departure became available ORD-DUS. However the DUS-HEL on Finnair was not available and the only availability on the final leg was a DUS-LHR-HEL which nets two hours longer.

I also found a SFO-HEL via PHL, but that AA750 segment is on an ancient 752 which has not been updated since the end of the cold war. That statement might not be an exaggeration since that airplane still has overhead screens for movies!

Thus, no cigar today.

Availability changes frequently, but free route changes is one of the best benefits of AA awards. You can change the flight/dates as long as the departure and origin airport stays the same.

I’ll keep checking occasionally and will share with you when I find something. And I will find something!

When was the last time you changed a flight for a better itinerary?

Calculating 2015 Cash Back from the Amex Costco Card

In addition to miles and points programs, I’m a big fan of cash back cards. I include cash back cards like the Costco Amex and Citi DoubleCash in my inventory to complete my earning strategy.

Unless I can get category bonuses that exceed 2% cash back equivalent in value, I normally stick with a cash back card. When I travel, I am not afraid to spend the money where it matters because I’ve put a system in place to maximize the return on my normal spend. I think this hybrid strategy effectively leverages the best of both worlds.

However, some cash back cards come with annual fees and I must be able to justify the annual fees.

Today, I evaluated my 2015 cash back with the Costco card and found some surprising trends.

- I spend about $1k per year on gas, which is much lower than I thought (I mostly get gas at a nearby Costco, and I fill up for my wife as well).

- My major Costco purchases in 2014 were in the summer time while in 2015 were evenly spread out.

I want to focus the attention on the gas because that’s the single largest cash back category for this card at 3%. Getting $30 back only covers 60% of the annual fee on a Costco membership ($50). How do I maximize the value of this card (why am I paying the annual fee)?

I realized that I must think of the card this way: access to higher values for the products carried by Costco. Costco products are not the cheapest products, but on a per unit basis compared to competitor stores, I often save 2-4%. I spent about $1k on products last year, so my savings is $20-40.

On gas, specifically, the membership grants access to much cheaper top-tier gas. Costco gas has consistently been 25-35 cents below market price per gallon. The average price for gas last year was about $2.50 per gallon and the savings were equivalent to roughly 15%. That means I saved about $150.

So if I add up the value of the products and gas, the membership has more than paid for itself.

I can think of the cash back roughly paying for the cost of membership, while the net benefit is in the access to lower prices, especially on gas.

How have you justified the expense/annual fee on your credit cards?

Progress to book flights to Finland: Part 5 Final Route

Progress to book flights to Finland: Intro

Progress to book flights to Finland: Part 2

Progress to book flights to Finland: Part 3

Progress to book flights to Finland: Part 4 Routes

To continue the story, I had found many possible routings from San Francisco, CA to Helsinki, Finland. However, they vary in airlines, fare class, stopover locations, stopover duration, fuel surcharges, and many other criteria.

In this post I will reveal what we ended up selecting, but before I do that, I want teach you what to do when you are stuck.

When you are stuck, get unstuck by reviewing your preferences and accept small compromises.

At the end of the last route-finding sprint, we decided not to stopover in Iceland or Ireland. But we still had many options:

- See which alliance has easier routing (direction) and book that route first.

- Determine if we are ok with more than two stops.

- Searching on Qantas website for Oneworld availability (could be different from AA or BA)

Then look at revenue fare on Icelandic air for the way back. Might be reasonable. Use LH or SAS to get to KEF from Berlin/Hamburg/Oslo (positioning flights).No longer going there.- Try two stop with one of the stops in the east coast somewhere.

- Connect on the outbound in Oslo or CPH and visit there instead of Iceland.

- Book the outbound with UA miles and use the AA miles for something else.

I normally travel off-peak. But some destinations are far more desirable in a particular season. For example, I go to Finland for the summer saunas. In mentally preparing myself for a more difficult search, I reduce disappointment and keep up my spirit.

Alas, that is the pain and beauty of this field.

So, back to the drawing board, but don’t erase the previous work!

Earlier I tried CPH-SFO, but the award search engine missed a valid connection through IST. By searching segment by segment I was able to piece together an inbound from CPH. That seems like a cool place to visit.

I think I’ll shoot for the CPH-IST-SFO on 7/29. That places my outbound around 7/16 (2 week trip). Cash tix HEL-CPH are reasonable from $100 – $300 or I could use BA Avios, which is also reasonable depending on the carrier.

But a quick search shows no outbound availability 7/15-7/17. I have to be more flexible with my dates, so I extended the range a couple days both ways to find something. I found two routes possible routes by looking at 7/13-7/19:

- sjc-ord-dus-hel

- sfo-jfk-lhr-hel

I prefer route two since the hard product across the pond is much nicer on AA’s 777-300ERs, but there is currently no availability. The SJC outbound has availability and I can book the 763 (not as nice as the 773) and change the date later as award availability opens up, but I have to lock in my departing airport – SJC or SFO. AA has a unique feature in that you can change the date and routing of any award flight as long as the destination and origin airports are the same.

I decided to go with SJC and forgo my SFO-JFK-LHR-HEL option in the 773 later on. I think that’s fine given that with SJC, I have a slim chance at opting for the SJC-LHR direct w/o YQ if there is IRROPS.

Then, I finally booked the inbound TK flights CPH-SFO. For each person there was about $270 in taxes (accurate to ITA Matrix) + $20 A3 booking fee, but it was the best way to redeem A3 miles thus far. The same flight would have cost 25k more in UA miles and the change policy is much less lenient. Considering most people got into A3 mostly for the easiest *G in the alliance two years ago, this was a great way to liquidate the ‘orphaned’ miles. The 15 min phone call to book the flight was simple and pleasant as well. Finally, though 7 CPM is something to be proud of, it doesn’t matter since I would almost never buy this anyway. This is an example where CPM fallacies can hold people back from pulling the trigger on an acceptable route.

Poor award availability and lack of partners limited our ability to route through Iceland. However, between Dublin and Copenhagen, we are looking forward to enjoying some time in CPH.

Now the last thing I need to book is the HEL-CPH connection flight on either BA Avios or cash ticket. I am also exploring the possibility of taking a boat from HEL to CPH. But overall, the flights in this trip are secured!

What a ride!

What has been your experience booking award tickets to non-standard destinations?

You must be logged in to post a comment.